BANGKOK 23 January 2026: Thailand’s tourism industry stands at a defining crossroads, with regional travel demand across Asia moving up a gear as Thailand’s performance decelerates.

The divergence is now clear. While neighbouring destinations such as Vietnam and Japan are capturing growth and market share, Thailand is contending with declining foreign arrivals and softer momentum from core source markets. Leadership in Asian tourism no longer depends solely on scale. It now rests on infrastructure readiness, ecosystem coordination, safety perception and value competitiveness.

At yesterday’s TTF 2026, C9 Hotelworks managing director Bill Barnett told the 1,300 attendees at the annual event that “the most pronounced shift was unfolding in the China outbound market, once the cornerstone of Thailand’s tourism engine.”

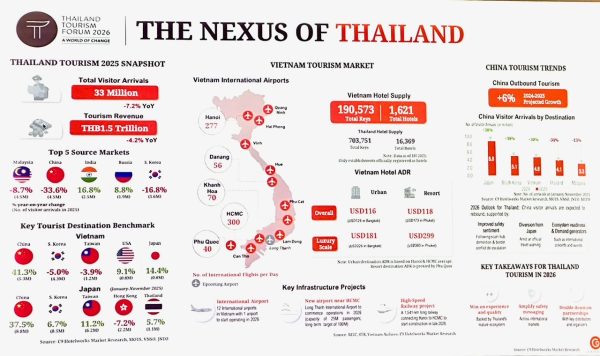

Chinese outbound travel was projected to return close to pre-pandemic levels by 2025. However, Thailand’s share of that recovery eroded. Travellers are redirecting towards destinations perceived as safer, better connected and more competitively priced, notably Vietnam.

“This reflects a broader recalibration in traveller priorities. Safety standards, transport efficiency, seamless airport experiences, digital connectivity and perceived value for money are now decisive factors in destination choice,” he said.

Thailand’s challenge is not one of demand. Demand exists and is growing. The issue is relative competitiveness. For decades, Thailand has relied on brand familiarity, depth of hospitality, and sheer scale of tourism. Today, competitors are closing the gap and in some cases leapfrogging ahead through faster infrastructure rollout and sharper policy alignment.

Vietnam’s rise is especially instructive. It illustrates how a coherent national strategy can rapidly reshape regional tourism positioning. Vietnam is experiencing outsized growth driven by lower prices, the aggressive expansion of airport capacity, and the accelerated development of second- and third-tier destinations. Hotel average daily rates in Vietnam are lower than in Thailand’s urban and resort destinations, reinforcing its appeal as a high-value alternative.

Connectivity is central to Vietnam’s advantage. The country now operates 12 international airports, with the new Long Thanh International Airport for Ho Chi Minh City scheduled to commence operations in 2026. Once operational, Long Thanh will become one of Southeast Asia’s largest aviation gateways, easing congestion and enabling a significant expansion in long-haul and regional connectivity. Crucially, Vietnam’s aviation strategy is not confined to a single mega hub. The footprint of international airports across multiple destinations points to a deliberate policy of distributing tourism growth beyond Hanoi and Ho Chi Minh City. This decentralised model is accelerating development in secondary cities and coastal resort zones, spreading economic benefits and broadening the national tourism ecosystem.

Thailand, by contrast, remains heavily concentrated around a limited number of gateways and mature destinations. Bangkok’s Suvarnabhumi Airport continues to face capacity and efficiency constraints, while progress on major aviation and rail projects has been slower than regional peers. Although expansion plans are underway, the pace of delivery has not kept pace with the urgency of competitive pressures. Infrastructure readiness is now a strategic differentiator, not a background variable.

Safety perception is another critical fault line. Thailand’s brand remains powerful, but periodic high-profile incidents and uneven enforcement of safety standards across destinations have weakened it. In the Chinese outbound market in particular, safety narratives carry disproportionate weight. Even isolated incidents can have outsized reputational effects in the age of social media. Competing destinations have invested heavily in visible safety upgrades and stronger public communication. Thailand’s response has been more fragmented, leaving gaps in confidence that competitors have exploited.

Value competitiveness further complicates the picture. Thailand’s tourism sector has benefited from years of strong demand, enabling hotel rates and ancillary costs to rise steadily. However, in a more price-sensitive post-pandemic environment, relative value now matters more than absolute quality. Vietnam’s lower hotel rates, combined with expanding connectivity and improving service standards, present a compelling alternative. Japan has similarly benefited from a weak yen, turning major cities into perceived bargains for regional travellers.

These shifts highlight a hard reality. Thailand’s traditional leadership model, built on volume, brand recognition and destination maturity, is no longer sufficient. Strategy, infrastructure and ecosystem readiness now define success.

Three priorities stand out for the 2026 tourism agenda

A step change in strategic infrastructure investment is essential. Aviation capacity, rail connectivity, urban mobility and digital tourism services must be treated as core competitiveness assets.

Safety standards must be raised consistently across destinations and segments, supported by visible upgrades and clear communication.

Second and first-tier cities should be actively promoted through policy alignment and budget planning to broaden market readiness and capture shifting global travel demand.

The Chinese market deserves special attention. Chinese outbound travel will remain one of the world’s largest drivers of tourism demand. However, the era of automatic Thai market dominance is over. Winning back share will require targeted airline partnerships, competitive pricing, safety assurance campaigns and product differentiation that goes beyond beach tourism.

Thailand’s tourism future will not be shaped solely by volume. It will be shaped by how quickly the country adapts to a more competitive, value-conscious and infrastructure-driven regional landscape. The inflexion point is now. The decisions taken in 2026 will determine whether Thailand regains leadership momentum or continues to cede ground to faster, more agile competitors.

About the Author

Andrew J Wood is a British-born travel writer, former hotelier and tourism consultant who has lived in Thailand since 1991. A graduate of Napier University, Edinburgh, he began his hospitality career in the early 1980s and brings more than four decades of experience across leading hotel groups in Asia and Europe, including Shangri-La, Minor International, Landmark Hotels and the Royal Cliff Group.

He is a former Director of Skål International, Past President of Skål International Asia, Past President of Skål International Thailand and a two-time Past President of Skål International Bangkok. He is a regular contributor to international travel and hospitality publications, writing on tourism policy, sustainability, destination development and travel trends across the Asia Pacific region.

Thank you, Liza, for sharing your thoughts so candidly. I understand where much of your frustration comes from. I’ve lived in Thailand for more than 35 years, and I often see the very things you describe—uneven pavements, poor accessibility, confusing urban development and road safety issues that simply should not exist in a country so dependent on tourism.

Thailand is my home, and because of that I probably notice the shortcomings even more. Sidewalks, in particular, remain a constant challenge. I agree they can be unsafe, cluttered and unfriendly for wheelchair users, parents with pushchairs and even ordinary pedestrians. These are not minor issues, and they deserve far more attention than they currently receive.

That said, Thailand is also very different from where many visitors come from. Much of Asia has grown organically rather than through rigid planning systems. It has its own rhythm and character, sometimes charming, sometimes chaotic, and not always efficient or easy to navigate. Comparing it directly with Western infrastructure standards can be confronting, especially for first-time visitors.

It may not feel like “home” to everyone, but for many of us it is home, imperfect, evolving, and still capable of improvement. The challenge now is ensuring that Thailand’s warmth, hospitality and cultural richness are matched by safer, more accessible public spaces for locals and visitors alike.

Your concerns are valid, and respectful criticism has an important role to play in encouraging chang

Thailands infrastructure is terrible. There is i saw a temple in Phuket, on one side was a very modern house,on the other there was a condo in the making .Who lets this happen? Safe to walk pavements are practically non existant with all sorts of poles etc stopping wheelchairs and baby push chairs from passing. And death trap low hanging signs which often Knock walkers out.

Buildings collapsing, sink holes and dangerous bridges, 20 000 deaths a year on the roads making them in the worlds worst top list. A lack of functioning traffic lights, no radars ??? No police presence, too many drunk and drugged tourists, doesn’t make the country family friendly at all.

Thailand has become the « Fawlty Towers » of tourism.