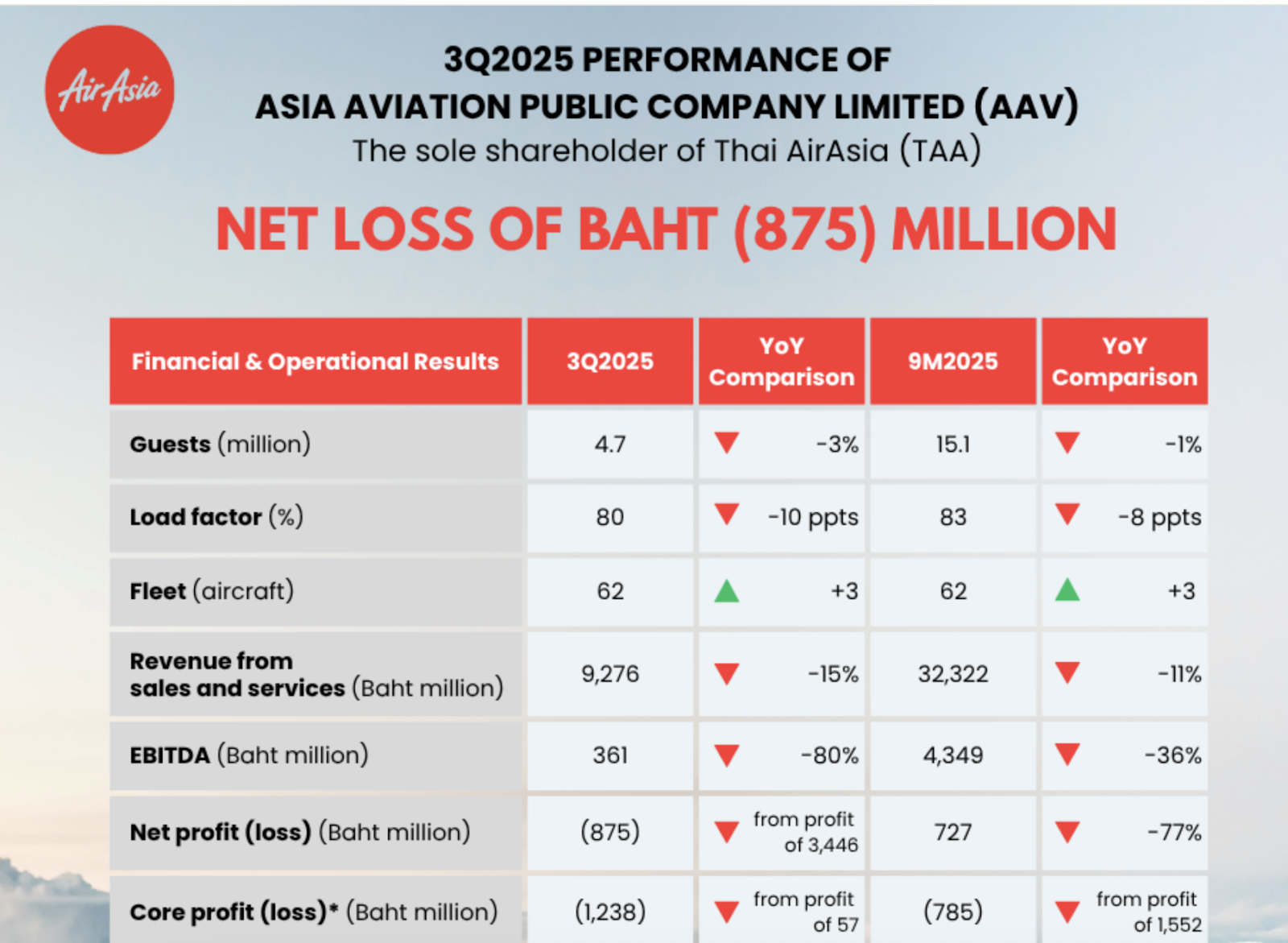

BANGKOK, 17 November 2025: Asia Aviation Public Company Limited (AAV), major shareholder of Thai AirAsia (“TAA”), has declared its financial results for the third quarter of 2025 with revenue from sales and services of THB9,276 million, down 15% year-on-year, mainly due to a 3% decline in passengers carried, 12% lower average fare to THB 1,633, and the effect of the low travel season in the aviation industry.

Cost of sales and services decreased 2% YoY, supported by lower fuel prices and effective cost control, despite increased flight operations compared to the same period last year. Cost per ASK (CASK) declined 2% YoY. As a result, the company recorded EBITDA of THB361 million and a net loss of THB(875) million. Excluding foreign exchange impact, AAV reported a core operating loss of THB(1,238) million, compared to a core operating profit of THB57 million in the same period last year.

During the quarter, TAA operated 5.93 million seats, up 9% YoY, comprising 3.90 million domestic seats (up 19%) and 2.03 million international seats (down 6%). Passenger numbers totalled 4.73 million, a 3% decline, with a load factor of 80%. At the end of the quarter, TAA operated a fleet of 62 aircraft, of which 54 were in operations.

For the nine months of 2025, AAV reported revenue from sales and services of THB32,322 million, a decrease of 11% YoY. The company operated 18.24 million seats and achieved a load factor of 83%, down from 91% compared to the same period last year, reflecting a slowdown in the overall tourism industry. The company reported EBITDA of THB4,349 million, a 36% decrease, and a net profit of THB727 million, down 77%. Excluding foreign exchange impact, the company reported a core loss of THB(785) million, compared to a core profit of THB1,552 million reported in the same period last year.

AAV and TAA, Chief Executive Officer Santisuk Klongchaiya said: “Our third-quarter performance reflects the seasonal nature of the business and the economy that has yet to recover fully. Nevertheless, we continue to exercise strict cost discipline while enhancing flexibility in fleet and network management to capture the expected strong rebound in travel demand towards the year-end, in both domestic and international markets, such as Japan, which is benefiting from the weak yen, as well as the Indian market, where tourist numbers are expected to keep hitting new records this year.”

“In 3Q2025, we continued to perform well in the domestic market, increasing seat capacity by 19% YoY to meet sustained travel demand. During the quarter, we launched new routes from Suvarnabhumi to Buriram, Narathiwat and Surat Thani, helping lift our domestic load factor to 82% while maintaining a 39% market share.”

For international operations, routes within CLMV (Cambodia, Laos, Myanmar, Vietnam) and Fifth-Freedom routes continued to perform well, led by strong demand on the Taipei–Okinawa service. In contrast, capacity on China routes was reduced by 38% YoY to align with the slower return of Chinese travellers, helping maintain a healthy load factor of 80–85%. The Indian market continued its positive growth trajectory, with seat capacity up 17% YoY. TAA also introduced new product bundles, such as airfares with prepaid baggage options, to better suit the preferences of Indian travellers.

According to data from Thailand’s Ministry of Tourism and Sports, the total international visitors to Thailand in Q3 2025 declined 13% YoY to 7.43 million, partly due to weakened confidence following reports of regional tensions. Chinese visitor arrivals decreased by 37% to 1.15 million, while arrivals from South Asia and Europe increased by 17% and 8%, respectively.

“We are confident that performance will improve in the fourth quarter, which is the peak travel season. We are expanding opportunities to attract more international travellers through our Fly Thru connecting service, which links international routes to domestic destinations across all regions. In addition, the business is expected to gain further momentum from the government’s tourism stimulus measures, such as the ‘Travel and Get Cash Back’ campaign (Thiaew Dee Mee Khuen), tax deduction schemes for domestic travel expenses, and the ‘Khon La Khrueng Plus’ co-payment program to boost spending. These initiatives are anticipated to support domestic travel demand significantly,” said Santisuk.

(Source: AAV)