SAMUI ISLAND, 13 June 2025: The Koh Samui hotel and tourism market is demonstrating solid growth through the first four months of 2025, supported by strong air and cruise arrivals, stable hotel performance metrics, and impressive European market engagement.

From January to April 2025, Samui International Airport recorded 1,127,832 passenger arrivals, representing a 9% increase over the same period in 2024. This follows a strong performance in 2024, which saw total air arrivals reach 2.78 million—an increase of 21% year-on-year, surpassing pre-pandemic levels in 2019, according to consulting group C9 Hotelworks’ newly released Samui Hotel & Tourism Market Review 2025.

Cruise tourism also contributed to overall growth. The island welcomed 35 cruise ships carrying 65,792 passengers in the first four months of 2025 — a 6% year-on-year increase. In 2024, Samui hosted 50 cruise liners, nearly doubling the number of arrivals compared to the prior year.

“Samui is increasingly attracting wellness-focused travellers who are contributing to a shift in the island’s tourism profile,” said C9 Hotelworks Managing Director Bill Barnett. “Properties such as Kamalaya continue to lead the way in capturing this segment, characterized by year-round visitation and longer average stays. We’re seeing Thailand — and Samui in particular — benefiting from a global uptick in wellness tourism, which offers strong potential for sustainable, high-value growth in the hospitality sector.”

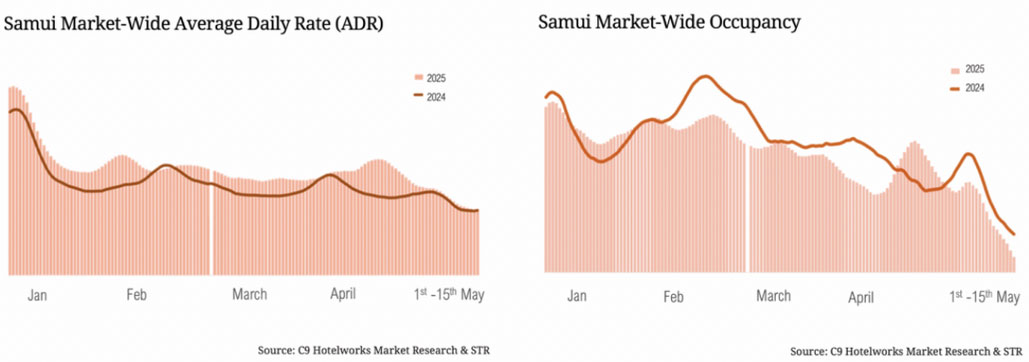

Hotel sector performance remained resilient. Occupancy levels peaked in January 2025, with an 8% year-on-year increase. While there was some softening in Q1 during the Chinese New Year period, overall occupancy in 2024 rose 12% compared to 2023. Average Daily Rate (ADR) continued to climb, with a 9% year-on-year increase in 2024 and a notable 21% year-on-year rise recorded in April 2025.

“Samui’s hotel performance in early 2025 reflects a steady and encouraging trend,” said STR Area Director Asia Pacific Jesper Palmqvist. “We see meaningful growth in both occupancy and average daily rates, signalling sustained demand in key source markets and a positive pricing environment. The market is not only recovering but also showing signs of structural stability, supported by disciplined supply growth and targeted international connectivity.”

Europe remains the leading international source region, accounting for 56% of arrivals in 2024, driven by travellers from Germany, the United Kingdom, and France. Growth in these markets has been supported by expanded codeshare agreements between Bangkok Airways and 30 global carriers. Another boost to airlift is the Singapore Airlines Scoot service, which not only serves regional travellers but also links to SQ’s Lion City hub for easy transit of long-haul passengers.

“The long-haul market has performed exceptionally well for us this year. It’s been a key strategic focus, and we’re pleased to see that effort translating into strong results,” said Banyan Tree Samui and Banyan Tree Krabi Area General Manager Remko Kroesen.

The hotel development pipeline signals continued investor confidence. Koh Samui currently has 634 registered accommodation providers with 24,188 keys. While overall supply has remained stable with a five-year CAGR of 1%, new branded properties are scheduled to open in the near term, including Nivata Koh Samui (Tapestry Collection by Hilton, opening Q4 2025) and SO/ by Sofitel and Fivelements Samui (both expected in 2026).

“The pandemic challenged us to rethink luxury through safety, sustainability, and innovation. As travel rebounds, demand from both traditional and emerging markets continues to strengthen Koh Samui’s position as a leading luxury destination,” said Centara Reserve Samui Director of Sales & Marketing Thansita Sirapastuwanon.

Speaking about the prospects through year-end, Barnett voiced optimism: “Barring any external disruptions, sustained demand from European and Asian source markets, combined with limited new hotel supply and ongoing infrastructure investment, is expected to support continued growth in arrivals, hotel occupancy, and rates throughout the remainder of the year.”

To download and read the C9 Hotelworks Samui Hotel & Tourism Market Review 2025 Report CLICK