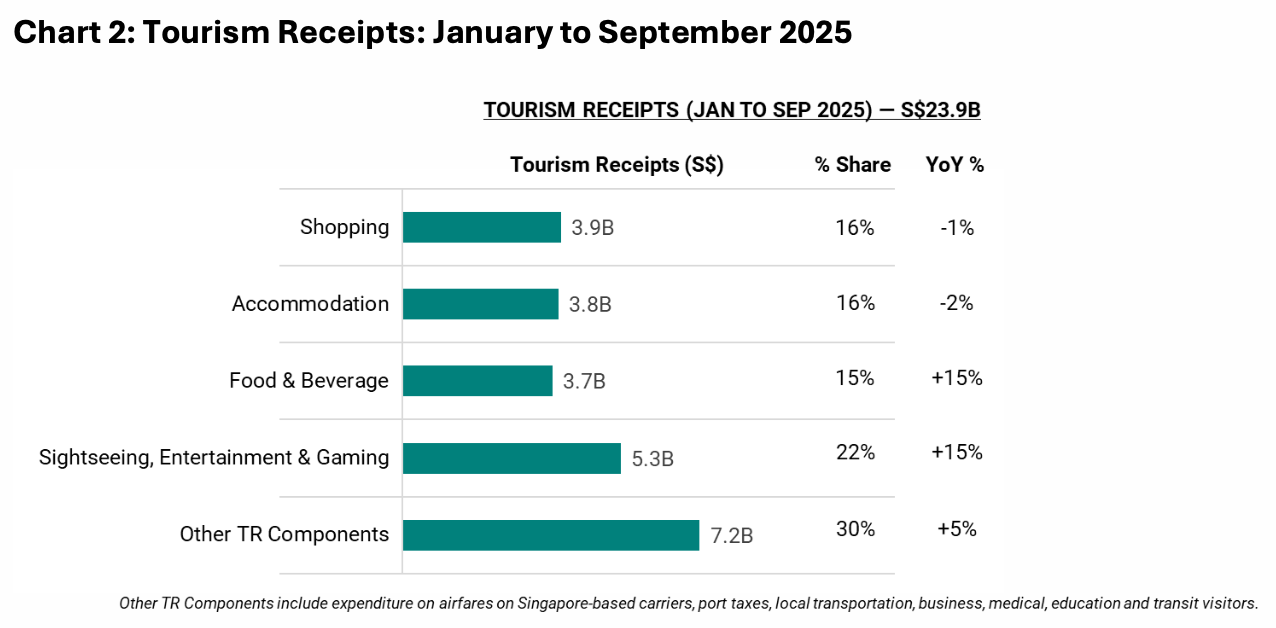

SINGAPORE, 9 February 2026: Singapore’s tourism sector showed steady growth in 2025, with tourism receipts (TR) reaching SGD23.9 billion in the first three quarters, a 6.5% increase over 2024 and the highest for this period.

“The strong tourism receipts performance in 2025 puts us on a steady trajectory towards achieving our Tourism 2040 ambitions (1),” said Singapore Tourism Board Chief Executive Melissa Ow. “We are attracting visitors who value the distinctive experiences that Singapore offers.

To maintain this growth momentum and reinforce our destination appeal and global hub status, we will continue to develop a strong pipeline of differentiated products, events, and experiences.”

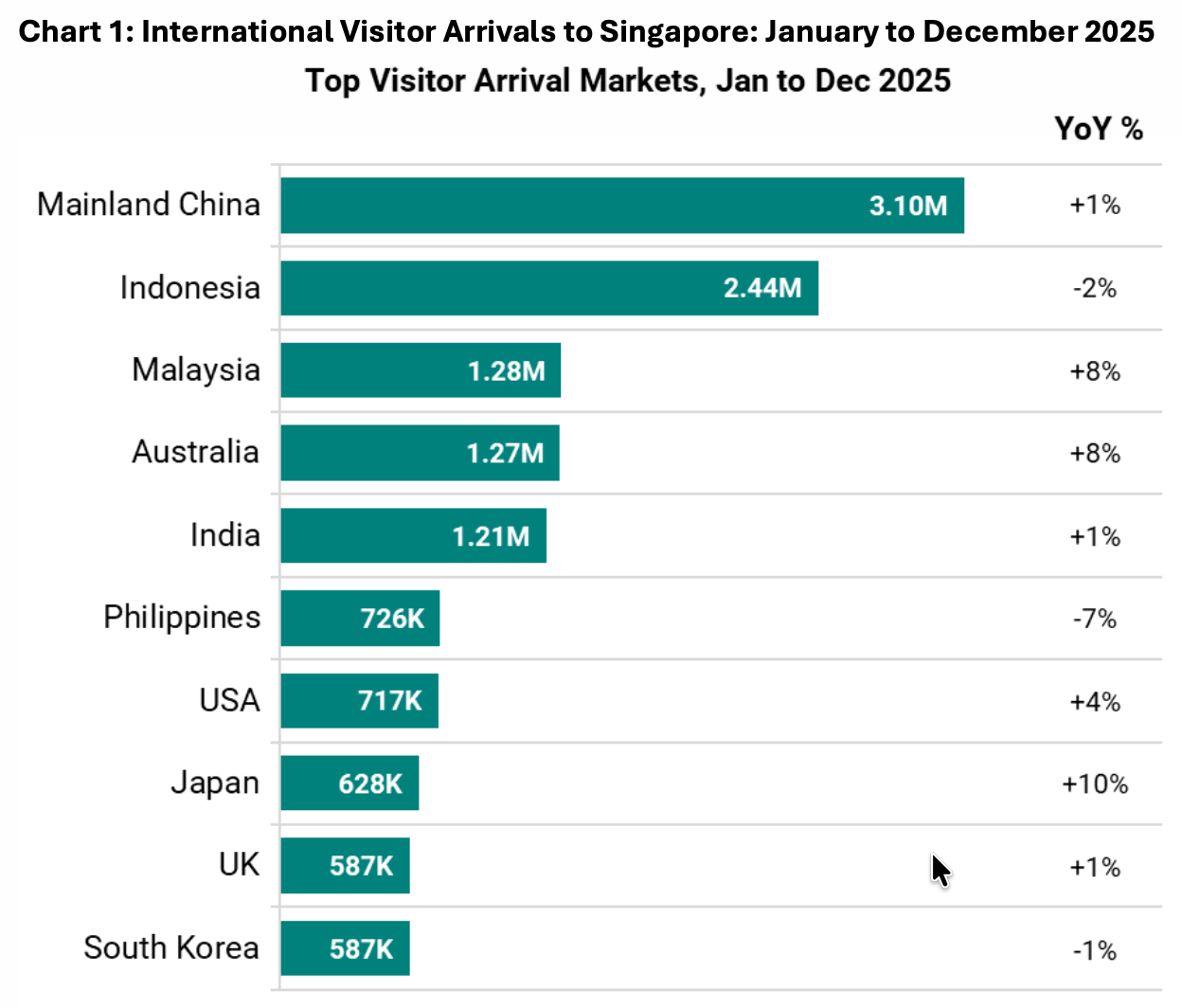

International visitor arrivals to Singapore in 2025 reached 16.9 million, up 2.3% from 2024, with Mainland China (3.1 million), Indonesia (2.4 million), Malaysia (1.3 million), Australia (1.3 million), and India (1.2 million) the top five markets.

Tourism performance highlights

Tourism receipts performance from January to September 2025 puts full-year performance on track to exceed STB’s projections of S$29.0 to SGD30.5 billion for 2025 (2).

Tourism receipts growth was driven mainly by sightseeing, entertainment & gaming, and food & beverage (F&B), each up 15%. Mainland China, Indonesia, and Australia were the top TR-generating markets, contributing SGD3.68 billion, SGD2.09 billion and SGD1.54 billion, respectively (3).

As the top TR-contributing market, Mainland China grew 3% year over year, with F&B consumption leading growth at 19%.

1 Tourism 2040 | Singapore Tourism Board.

2 STB’s projections for 2025 were for international visitor arrivals to reach between 17.0 and 18.5 million, bringing in approximately SGD29.0 to SGD30.5 billion in tourism receipts. The full-year 2025 TR figure will be available in 2Q 2026.

3 excluding Sightseeing, Entertainment & Gaming. In line with previous practices, STB excludes Sightseeing, Entertainment & Gaming in the country analysis due to commercial sensitivities.

The top markets for international visitor arrivals (IVA) were Mainland China (3.1 million), Indonesia (2.4 million), Malaysia (1.3 million), Australia (1.3 million) and India (1.2 million), with Australia (+8%) contributing a record number of international visitors.

IVA in some markets declined year over year, including Vietnam (344,000 vs 393,000 in 2024), likely due to greater price sensitivity to travel. Similarly, IVA from the Philippines decreased to 726,000 from 779,000 in 2024, following the previous year’s spike driven by large-scale entertainment events in Singapore.

Overall, the total IVA remained healthy, with notable growth recorded in Japan (+10%), Malaysia (+8%), Germany (+5%), and the US (+5%), reflecting a good mix of short-, mid- and long-haul markets.

The hotel industry maintained stable performance in 2025, with Average Occupancy Rate (AOR) increasing year-on-year to 81.9% from 81.4% in 2024. Average Room Rate (ARR) was SGD273.56 (-1%) and Revenue per Available Room (RevPAR) was SGD224.04 (-0.4%).

Hotel capacity expanded with 644 new hotel keys added to Singapore’s accommodation landscape.

The cruise industry also demonstrated strong momentum with 375 ship calls (+10%) and over 2.0 million passenger throughput (+9%), cementing Singapore’s position as the region’s leading cruise hub in 2025.

New experiences boost visitor spending

The strong tourism spending can be attributed to the new and refreshed experiences

across multiple industries, including attractions, cruises, events, and MICE.

Attractions

Several major attractions opened in 2025, enhancing Singapore’s destination appeal.

These included Rainforest Wild, Singapore’s fifth wildlife park and Asia’s first adventure-based zoological park, and Curiosity Cove, Singapore’s largest indoor playscape with over 30 experiential features, both at Mandai Wildlife Reserve.

Other notable additions were Jurassic World: The Experience at Gardens by the Bay’s Cloud Forest and Singapore Oceanarium at Resorts World Sentosa.

Rejuvenation efforts enhanced existing attractions, such as the Chinatown Heritage Centre, which reopened with refreshed exhibits and character-led tours, and SuperPark’s expansion, which added climbing walls, trampoline arenas, and a games arena. Singapore Flyer refreshed its Time Capsule with a pre-flight experience featuring 10 interactive themed zones showcasing Singapore’s 700-year transformation.

(Source: STB)