SINGAPORE, 12 June 2025: The Qantas Group announced on Wednesday a strategic restructuring which supports its historic fleet renewal program and strengthens its core businesses in Australia and New Zealand.

The closure of intra-Asia airline Jetstar Asia on 31 July 2025 enables the Qantas Group to recycle up to AUD500 million in capital, supporting its historic fleet renewal programme.

Thirteen Jetstar Asia Airbus A320 aircraft are to be progressively redeployed to Australia and New Zealand, bringing more low fares and more local jobs.

Only 16 intra-Asia routes will be impacted by the closure of Jetstar Asia, with no changes to Jetstar Airways and Jetstar Japan services into Asia. All of Jetstar Airways’ international services, both in and out of Australia, remain unchanged.

Closure of Jetstar Asia

Jetstar Asia, the Group’s Singapore-based low-cost subsidiary, has faced growing challenges in recent years. The decision has been made, together with majority shareholder Westbrook Investments, to close the airline.

Despite delivering exceptional customer service and operational reliability, Jetstar Asia has been impacted by rising supplier costs, high airport fees, and intensified competition in the region. This has fundamentally challenged the low-cost airline’s ability to deliver returns comparable to the stronger-performing core markets in the Group.

The airline is expected to post an AUD35 million underlying EBIT loss this financial year before the closure decision.

Jetstar Asia will continue to operate flights for the next seven weeks on a progressively reduced schedule, concluding its operations on 31 July 2025.

The closure of Jetstar Asia only impacts the intra-Asia routes operated by the airline from its base in Singapore. It does not impact Jetstar Airways’ domestic and international operations in Australia and New Zealand or Jetstar Japan. Jetstar Airways will continue to fly from Australia to Asia, including all its popular destinations across Singapore, Thailand, Indonesia, Vietnam, Japan, and South Korea.

Qantas Group CEO Vanessa Hudson said: “Jetstar Asia has been a pioneering force in the Asian aviation market for more than 20 years, making air travel accessible to millions of customers across Southeast Asia.”

“We are incredibly proud of the Jetstar Asia team and the work they have done to deliver low fares, strong operational performance and exceptional customer service. This is a very tough day for them. Despite their best efforts, we have seen some of Jetstar Asia’s supplier costs increase by up to 200%, which has materially changed its cost base.”

“I want to sincerely thank and acknowledge our incredible Jetstar Asia team, who should be very proud of the impact they have had on aviation in the region over the past two decades.”

Jetstar Asia customers with existing bookings on cancelled flights will be offered full refunds, and the Group will look to re-accommodate customers onto other airlines where possible.

All affected Jetstar Asia employees will be provided redundancy benefits as well as employment support services. Qantas is also actively seeking job opportunities across the Group and with other airlines in the region.

Singapore remains a critical hub for the Qantas Group as its third-largest international airport. Qantas also offers connections from Singapore through nearly 20 codeshare and interline partners to a variety of destinations across Asia.

With the support of Qantas, Jetstar Asia will continue to meet its financial obligations to suppliers, employees and customers.

Recycling of capital to drive improved returns and support fleet renewal

Disciplined allocation of capital is a key pillar in the Qantas Group’s Financial Framework. The closure of Jetstar Asia will unlock up to AUD 500 million in fleet capital, which can be recycled into the Group’s core businesses, thereby improving long-term returns.

Jetstar Asia’s 13 mid-life A320 aircraft will be progressively redeployed to core markets in Australia and New Zealand to support fleet renewal and growth, creating more than 100 local jobs and lowering fares. This redeployment will also replace leased aircraft in Jetstar Airways’ domestic operation, reducing its cost base. Some of the aircraft will also help accelerate fleet renewal in Qantas’ regional operations that service the critical resources sector in Western Australia.

These strategic fleet decisions come as Qantas receives its first Airbus A321XLR later this month and the first Project Sunrise A350-1000ULR in the calendar year 2026.

“We are currently undertaking the most ambitious fleet renewal programme in our history, with almost 200 firm aircraft orders and hundreds of millions of dollars being invested into our existing fleet,” Hudson said.

“We’re making disciplined decisions which recycle capital across our business and prioritise it to stronger performing segments as well as strategic growth initiatives like Project Sunrise.”

The financial impact of the closure of Jetstar Asia

The closure of Jetstar Asia will result in one-off redundancy and restructuring costs as well as the non-cash expensing of historical foreign currency translation losses[1] from equity reserves and asset write-downs from consequential changes in the Group’s fleet structure.

The combined impact is currently estimated to be approximately AUD175 million, with roughly a third in FY25 and the remainder across FY26, which will be taken outside of underlying earnings.

The direct pre-tax cash impact will be approximately AUD160 million, predominantly in FY26, including unwinding Jetstar Asia’s working capital. This will be materially mitigated by working capital benefits from growth in Jetstar Airways utilising the redeployed aircraft and from consequential tax adjustments impacting tax payments across the Group in FY26 and future years.

Key Group financial update for 2H25

The performance of Jetstar Asia deteriorated in the second half and is expected to post an underlying EBIT loss of AUD25 million.

Group Domestic capacity growth for the half is lower than previous guidance, mainly due to Cyclone Alfred in March, which impacted flying across large parts of Queensland. The disruptions from the Cyclone will have a AUD30 million impact on earnings.

Group International’s capacity for the first half is expected to grow by 9%, which is 3% lower than previously guided, due to the impact of industrial action on Qantas’ Finnair wet lease.

The Group continues to see strong demand across both domestic and international markets and expects unit revenue and capital expenditure to be in line with previous guidance.

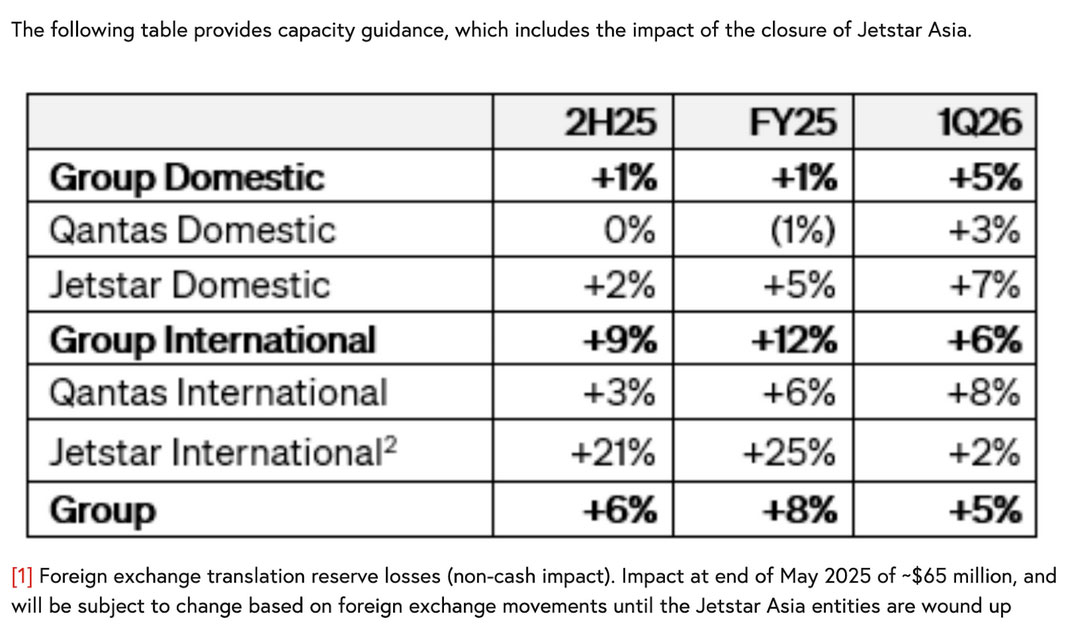

Capacity outlook

(vs prior corresponding period)