BANGKOK, 13 February 2026: By 2023, Thai Airways International (THAI) had achieved something few legacy flag carriers manage after bankruptcy: a credible, sustained return to profitability underpinned by structural reform rather than short-term demand spikes.*

Following court-supervised rehabilitation beginning in 2021, the airline emerged leaner, more focused and operationally coherent, benefiting from Thailand’s tourism recovery while avoiding many of the excesses that previously undermined its balance sheet.

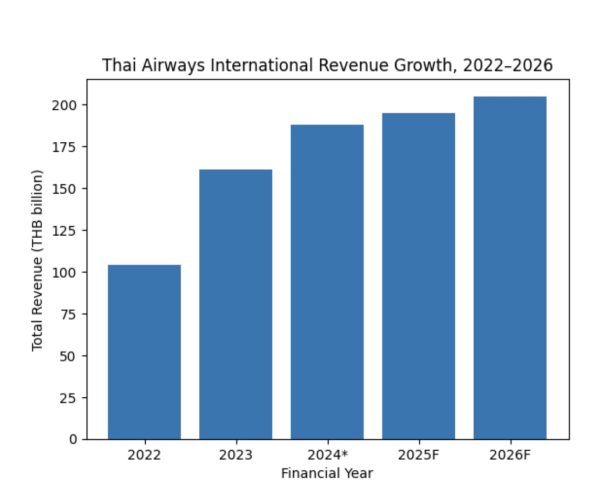

Between 2022 and 2024, Thai Airways transformed its financial trajectory. Revenue rose sharply from approximately THB 104 billion in 2022 to around THB 161 billion in 2023, before reaching an estimated THB 188 billion in 2024, a figure adjusted to exclude one-off rehabilitation accounting items. Analyst consensus forecasts point to continued, if more moderate, growth to roughly THB 195 billion in 2025 and THB 205 billion in 2026, reflecting capacity discipline and yield management rather than aggressive expansion.

This rebound was enabled by decisive financial restructuring. At the start of rehabilitation, THAI faced debt exceeding US$11 billion, accumulated over years of weak governance, political interference and inefficient fleet planning. Debt haircuts, equity conversions and creditor negotiations dramatically reduced financial pressure, while tighter capital controls curtailed loss-making behaviour. Unlike earlier turnaround attempts, this process was externally enforced, limiting the scope for reversal.

Operational reform proved equally critical. Thai Airways exited marginal routes, particularly in secondary European and South Asian markets, and redeployed capacity to high-yield sectors including Japan, Australia and core European gateways. The integration of Thai Smile into the mainline operation simplified branding, eliminated duplication and improved aircraft utilisation across short- and medium-haul services.

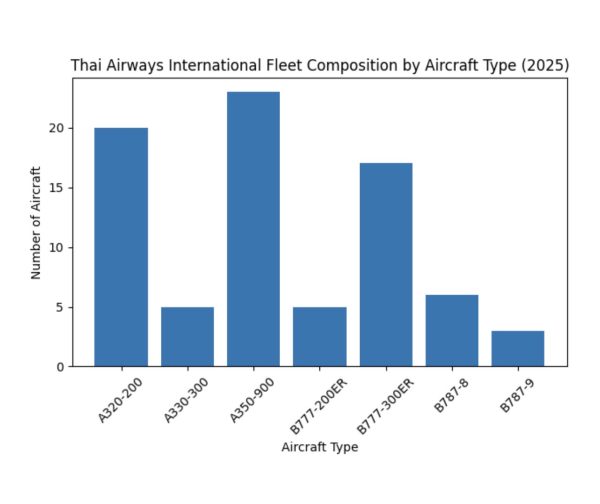

Fleet restructuring has been central to the airline’s improved cost base. By 2025, THAI presented a streamlined wide-body-centric fleet dominated by Airbus A350-900s and Boeing 777-300ERs for long-haul services, complemented by Boeing 787s for thinner intercontinental routes and Airbus A320s on regional sectors. Importantly, the airline has retired older, maintenance-intensive aircraft types, significantly reducing engineering complexity and spare-parts inventories.

Fleet streamlined to six aircraft types

• Airbus A320-200 — 20

• Airbus A330-300 — 5

• Airbus A350-900 — 23

• Boeing 777-200ER — 5

• Boeing 777-300ER — 17

• Boeing 787-8 — 6

• Boeing 787-9 — 3

The average fleet age has fallen to the low-teens, a notable improvement from pre-rehabilitation levels. Newer aircraft not only reduce fuel burn and maintenance costs but also support a more consistent onboard product. Cabin refurbishment, harmonised seating and refreshed soft product standards have helped reposition Thai Airways as a competitive full-service carrier rather than a legacy brand trading on nostalgia.

Aircraft Overview: HS-TWA

Registration: HS-TWA

Aircraft Type: Boeing 787-9 Dreamliner (a long-haul wide-body airliner)

Operator: Thai Airways International

Nickname/Name: Phatthana Nikhom

Manufacturer Serial Number (MSN): 38777 / Line #602

First flight: 1 September, 2017

Delivered to Thai Airways: 14-15 September, 2017

Human capital reform has been more sensitive but no less important. Staff numbers were reduced substantially during the rehabilitation period, while new training regimes were introduced for cabin crew and frontline staff. The airline has also addressed age-profile imbalances and refreshed uniforms and grooming standards, aligning presentation with contemporary Asian and Middle Eastern competitors without abandoning Thai cultural identity.

From a service perspective, in-flight catering remains an area of debate. While Thai Airways continues to emphasise Thai flavours and hospitality, some critics argue that consistency still lags behind that of top-tier Asian rivals. Aviation and travel reviewers have offered mixed assessments, praising presentation and cultural authenticity while noting variability across routes and cabins. Management has acknowledged the issue and signalled further supplier rationalisation and menu standardisation.

Pricing dynamics also reflect the airline’s new discipline. Business-class fares, particularly on Europe–Bangkok routes, have risen materially since 2022, driven by constrained capacity, strong premium demand and limited competition. While this has raised concerns among some corporate travellers, yields have improved markedly, supporting profitability. Looking ahead, analysts expect premium fares to remain firm through 2026, especially as wide-body capacity across Asia remains structurally tight.

Competition, Thai Airways now operates in a transformed regional landscape. Singapore Airlines remains the benchmark for premium service, while Middle Eastern carriers dominate ultra-long-haul connectivity. Regionally, EVA Air, ANA and JAL exert pressure on North Asian routes, while low-cost carriers constrain pricing on short-haul sectors. THAI’s response has been to focus on network relevance rather than scale, leveraging Bangkok’s hub position and alliance connectivity.

Airport infrastructure has also played a role. Airports of Thailand (AOT) has benefited directly from the national carrier’s recovery through higher passenger volumes and improved slot utilisation at Suvarnabhumi. At the same time, congestion and capacity constraints underscore the need for continued airport investment to sustain aviation-led growth in Thailand.

A brief SWOT assessment illustrates Thai Airways’ current position. Strengths include a revitalised balance sheet, modernised fleet and strong home-market demand. Weaknesses persist in brand consistency and premium service delivery. Opportunities lie in sustained tourism growth, premium leisure travel and strategic partnerships. Threats include fuel volatility, geopolitical shocks and intensifying regional competition.

By 2026, Thai Airways will no longer be a turnaround story but a cautiously credible airline. The challenge ahead is not survival, but execution: maintaining cost discipline, investing selectively in product quality and resisting the temptation to expand for prestige rather than profit. For Thailand, the re-emergence of a financially viable flag carrier represents both an economic asset and a symbolic restoration of confidence in national aviation.