MUMBAI, 30 November 2022: Indian travellers identify the heightened importance of travel insurance post-pandemic, according to a recent survey by leading tour operator Thomas Cook (India) Limited and its group company, SOTC Travel.

The survey covered over 1000 consumers spread across India’s top metros. Travel consumers surveyed were residents in Mumbai, Delhi, Bangaluru, Kolkata, Pune, Ahmedabad, Lucknow, Jaipur, Chennai, Hyderabad, Surat, Indore, Bhopal, Patna, Tiruchirappalli, Madurai, Nagpur, Bhubaneswar, Chandigarh, Mysuru, Coimbatore, Visakhapatnam and Guwahati.

The critical finding suggested that while the pandemic increased the need for travel insurance, the continued demand to include insurance reflects the growing maturity of the Indian market.

Data analysis revealed valuable insights on customer requirements linked to travel insurance:

Strong requirement

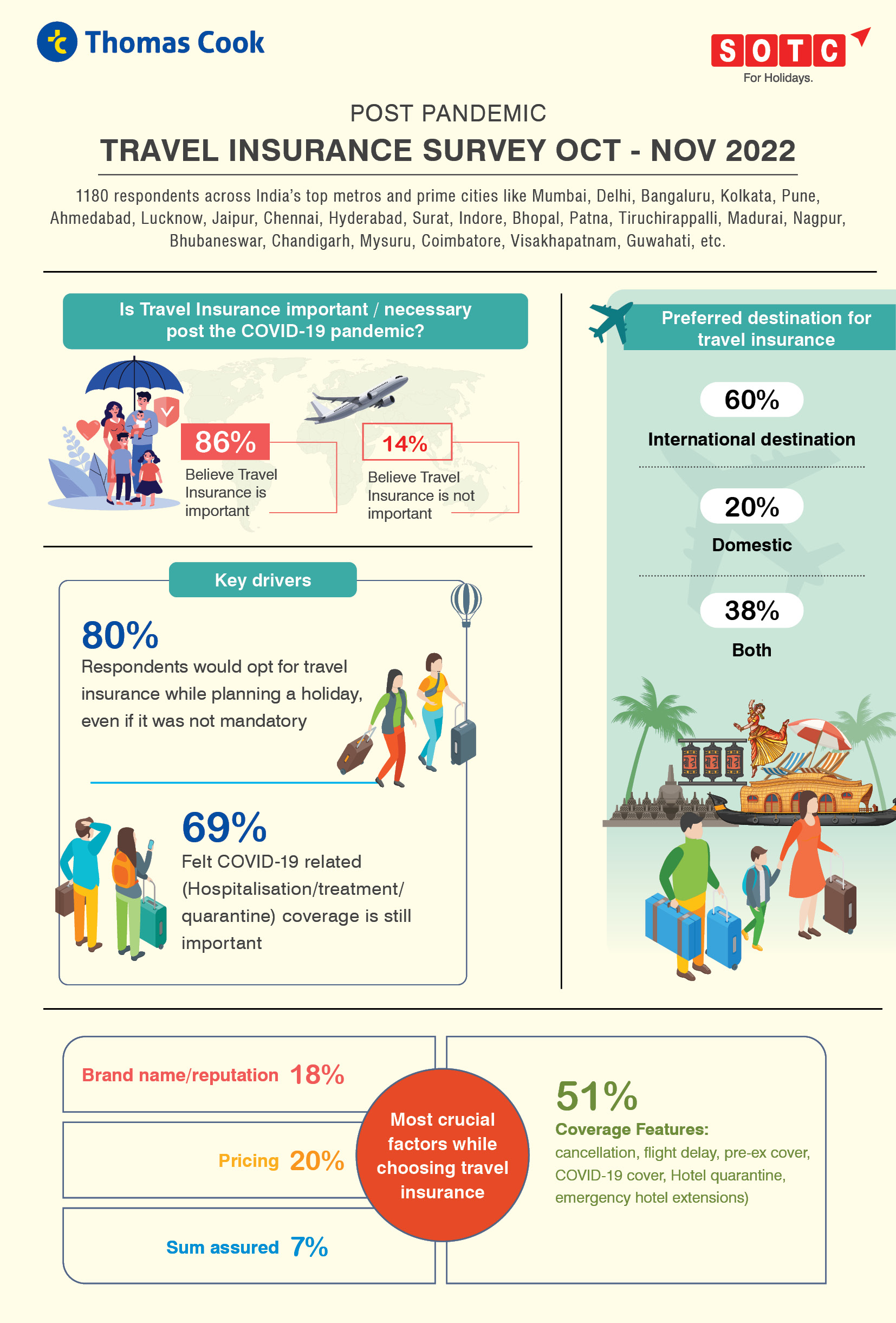

86% of respondents identified travel insurance as necessary in the post-pandemic era, compared with 75% highlighting health and safety as the primary concern in the 2020 First Holiday Readiness Travel Report.

80% of Indian travellers are keen to obtain travel insurance for themselves and their families, even if it is not mandatory during their travel or while obtaining visas.

Covid 19 coverage

Covid-19-related cover, including hospitalisation, treatment and quarantine, is essential for 69% of the respondents while planning their travel.

Insurance preference

A significant share of insurance preference is for international destinations (60%), while 38% of respondents are interested in taking out travel insurance for domestic and international destinations compared with less than 1% pre-pandemic to around 20% currently for domestic destinations.

Crucial factors when selecting your travel insurance

Insurance coverage should include cancellation, delay, pre-existing medical conditions, Covid-19 coverage, hotel quarantine, and emergency hotel extensions. They remain a top priority for over 50% of the respondents.

- Coverage costs – expenses play a major role when considering travel insurance, as 20% indicated that the insurance pricing should be reasonable.

- Insurance company – the name of the insurance company or reputation in the market is considered important by 18%

- Additional factors – claim settlement percentage, cashless hospitalisation, flight/trip cancellation, hassle-free reimbursement, delay, lost luggage/theft, and reliability are also important.

Thomas Cook (India) and SOTC Travel president & group head – marketing Abraham Alapatt said: “The pandemic changed several norms in the travel industry with health and protection gaining importance.

“The fact that customers continue to see value in comprehensive travel insurance is less an indicator of continuing concerns about the pandemic and more to do with a more mature customer mindset. This is more akin to customers in mature economies, where travel insurance is seen as a “must have” and not just good to have.”