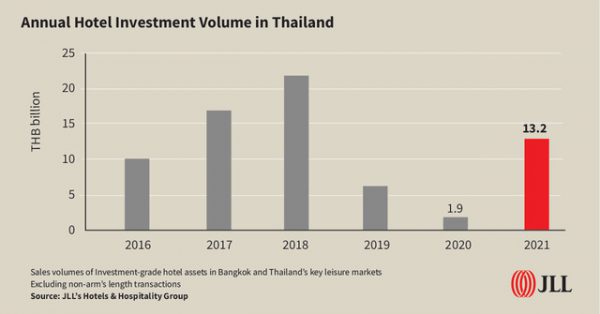

BANGKOK, 15 February 2022: Thailand saw 23 hotels sold in 2021 with approximately 3,000 keys and a combined transaction value of THB13.2 billion, according to the latest report from property consultant JLL.

It represents an increase of 550% from 2020 and 30% over the 10-year average pre-Covid volume witnessed between 2009-2019. JLL’s report covers sale transactions of investment-grade hotel assets in Bangkok and Thailand’s key leisure markets.

JLL Hotels & Hospitality Group executive vice president, investment sales Asia Chakkrit Chakrabandhu Na Ayudhya said: “In the wake of the pandemic, hotel investment activity in Thailand dipped in 2020 with an investment volume of less than THB2 billion. However, the hotel investment market rebounded strongly last year with sales volume increasing almost six times the volume recorded in 2020.”

“Interest from both local and international investors in Thailand’s hotel market started picking up in the second half of 2021 and has continued to grow. Investors have become more optimistic about the outlook for the country’s tourism market. Increased availability of investment-grade hotel assets offered for sale at more realistic prices is another key factor that has fuelled investor demand,” Chakkrit added.

Findings from JLL show that Thailand’s top three hotel investment destinations in terms on investment volumes last year were Koh Samui, Bangkok and Phuket, representing 44.3%, 24.6% and 11.7% of the countrywide volume respectively.

JLL’s Hotels & Hospitality Group senior vice president – investment sales, Pimpanga Yomchinda commented: “Generally, Bangkok is the top hotel investment destination in Thailand. But Koh Samui came in the first place last year because the island had more opportunities to offer compared to Bangkok and also saw Thailand’s largest hotel investment deal completed in 2021 on per asset basis.”

JLL’s data reveal that the average value of the 23 hotels sold last year was circa THB500 to 600 million per asset, with only one hotel in Samui sold at a price above THB1 billion, the average hotel transaction size witnessed in Thailand between 2010 and 2020.

Larger discounts on selling prices in resort markets where hotel owners have felt the stronger impact from the tourism market slump was another reason explaining how Koh Samui attracted more hotel investment than Bangkok in 2021.

“Prices of investment-grade hotel assets in Bangkok have held their ground throughout the pandemic period with generally no deep discounts relative to pre-pandemic levels. Over 75% of the transaction volume in the Thai capital city was considered to have only 0 to 5% discount compared to the pre-pandemic level, and the remaining 25% was sold by the Legal Execution Department at a public auction. On the other hand, assets in Phuket and Koh Samui have seen a larger discount,” Pimpanga noted.

JLL expects the momentum in Thailand’s hotel investment market to continue this year.

“We have seen several hotel investment deals that are currently under negotiation in Bangkok and key resort markets, and a number of these deals are worth over THB1 billion. In addition, the ease of travel restrictions across the region and Thailand will facilitate the participation of foreign investors, leading to higher competition for quality assets. For these reasons, we expect 2022 to be another active year for the investment market in Thailand with volume potentially surpassing that of 2021, not to mention that Thailand was the most active market in Southeast Asia in 2021,” Chakkrit concluded.