KUALA LUMPUR, 27 June 2025: Airlines based in the Asia Pacific are reporting continued growth in international passenger demand, supported by robust leisure traffic across the region, according to preliminary May 2025 traffic figures released Thursday by the Association of Asia Pacific Airlines (AAPA).

Air cargo markets also posted further gains, although the pace of growth moderated due to weaker export activity from key manufacturing economies.

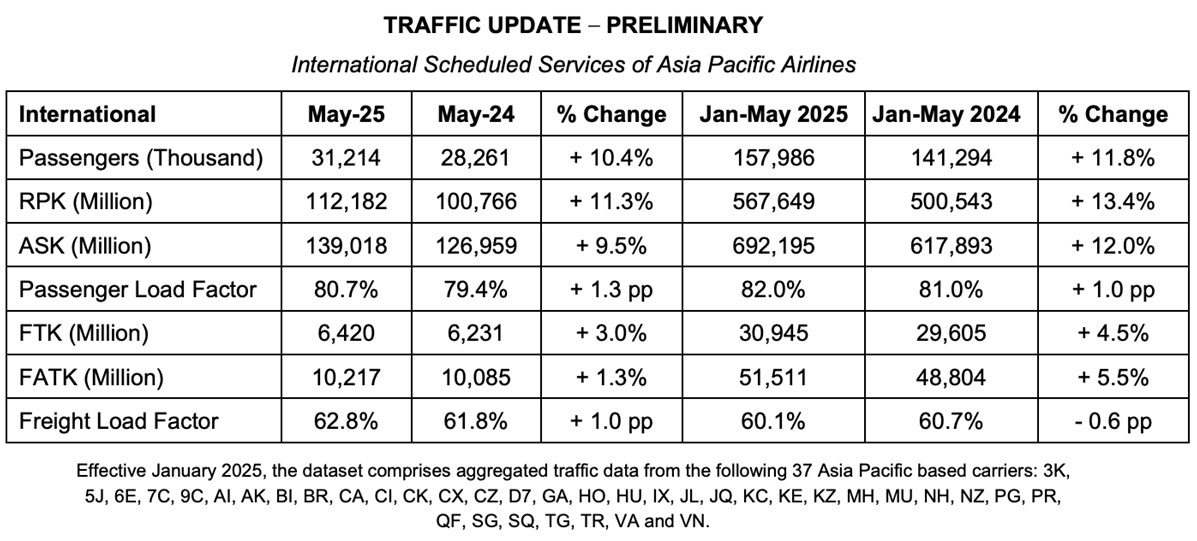

The region’s carriers registered a 10.4% year-over-year increase in international passengers carried, reaching a combined total of 31.2 million for the month. In revenue passenger kilometres (RPK) terms, demand rose by 11.3%, surpassing the 9.5% expansion in available seat capacity. Consequently, the average international passenger load factor increased by 1.3 percentage points to 80.7%.

Meanwhile, international air cargo demand, measured in freight tonne kilometres (FTK), grew by 3% year-on-year in May. Weaker export volumes on the US-China route, partly due to the removal of tax-free exemptions for low-value goods, were offset by increased shipments to other markets. Offered freight capacity rose by 1.3% year-on-year, resulting in a one percentage point increase in the average international freight load factor to 62.8% for the month.

Commenting on the results, AAPA Director General Subhas Menon said: “Air travel demand in the Asia Pacific region continued to see sustained growth on the back of strong leisure and business traffic.

“Overall, during the first five months of the year, Asia Pacific airlines carried a total of 158 million international passengers, a 12% increase over the same period the previous year. In the air cargo markets, international freight demand registered 4.5% growth, supported by front-loading of shipments and rerouting of goods to other gateways amidst mounting economic headwinds.”

Looking ahead, Menon noted: “Continued improvements in air connectivity are expected to support growth in travel demand. Nevertheless, Asia Pacific carriers face an increasingly challenging operating environment shaped by rising trade and geopolitical tensions, persistent supply chain constraints, and more frequent overflight diversions due to airspace closures in conflict zones. Additionally, fuel prices may remain volatile if the Middle East conflict persists.

“Meanwhile, air cargo markets are expected to come under pressure from weakening export orders, although shifts in trade routes could help mitigate some of the impact. Overall, the region’s carriers are well-placed to adapt to evolving market conditions, supported by strong regional economies that are expanding in tandem with their aviation markets.”