SINGAPORE, 25 February 2022: As the world learns to live with Covid-19, all eyes are on China, the world’s largest outbound tourism market, and its plans to reopen the door to overseas travel.

According to the Civil Aviation Administration of China’s five-year plan, which was published in January 2022, international flights will gradually resume between 2023 and 2025. But, with rumours circulating that China could start a slow reopening as early as this summer, everyone wonders, “what if China reopens? What will Chinese tourists look like post-pandemic?”

Will the same international destinations entice Chinese travellers as before?

In 2019, mature long-haul destinations captured a great share of Chinese outbound travel outside Asia. According to ForwardKeys data, those destinations included and was led by Europe (51% share of all trips outside Asia), the US (17%) and Australia (9%).

Popular destination cities in Europe, Australia and the USA included Paris, Los Angeles, Moscow, London, Sydney, Rome, New York, Frankfurt, Melbourne, and San Francisco, with London (+9%) and Moscow (+5%) showing the largest increases.

Digging deeper into the ForwardKeys data, the typical traveller profile to Paris, Moscow, Frankfurt, and Rome (European destinations) was groups whereas to London and the US destinations it was a different traveller – solo/business, while more family-sized groups travelled to Australia (than to any European or US destinations).

Pre-pandemic trips to other Asian destinations accounted for most of the outbound trips. Thailand, Japan, and South Korea were the top destinations of choice for Chinese travellers.

Within that trio, Japan did very well in improving its market share, from 10% in 2014 to 23% in 2019. Thailand continued to be the top destination with a 24% market share in 2019. South Korea’s had a 9% market share in 2019.

With all three mentioned destinations looking to reopen for business this year, could we see a reshuffle take place if Chinese travellers are allowed to travel internationally again?

According to Dragon Trail International’s most recent Chinese consumer sentiment survey, “despite very cautious assessments of safety outside of mainland China, 81% of survey respondents felt positive when they saw content on outbound travel. Keywords and sentiments that came up often included feeling fascinated and excited, and a craving for novelty, variety, and relaxation.”

New trends and traveller profiles

“Sports tourism is a trend to consider. Greatly encouraged by publicity surrounding the Winter Olympics in Beijing this year, we see the strongly growing enthusiasm for travel to snowy ski destinations in the Northeastern part of China. When outbound travel resumes, I think there could be more customised trips to famous winter destinations worldwide,” says China Market Expert Nancy Dai.

Examining the domestic travel results in the last few years, changes to the visitor profiles include:

- Millennials Plus – Young and middle-aged people will still be the main force of tourism in the post-pandemic era. The most important group of domestic tourists are currently young people aged 25-34, accounting for 30% of the total tourists. Young and middle-aged tourists aged 25-44 accounted in 2019 for 52% of the total tourists. And domestic tourists continue to show a trend of higher education. In 2019, 65% of domestic tourists had a college degree or above. They are showing increasing needs for a variety of customised and private tours. Consumption is shifting from sightseeing and shopping to more unique experiences and service-oriented products. The epidemic has strengthened young tourists’ usage of new technology: learning about destinations on emerging social-media platforms; sharing tourism experience via live-streaming sessions; online booking services; smart visitor flow management; digital tour guides; and virtual reality experiences at destinations.

- The Elderly Market – A segment to watch as China’s population ages. A survey done by the Tourism Research Centre of China revealed that China’s post-60s group had become the main driving force of China’s local tourism market. In 2020, more than 11% of the silver fox generation in China spent more than 10,000 yuan on travel – more than the post-80s generation. The China National Committee on Ageing predicts that the 60 plus group will reach a peak of 487 million by around 2050, accounting for over a third of the total population.

- “With the improvement of the quality of life, many elderly people would eager to travel. However, for outbound travel, they prefer to choose neighbouring countries or regions with shorter flight times for more convenient travel,” says Dai.

- Middle-Class Parents – More family travel to come. According to a recent survey, Chinese parents spend an average of US$1,250 per child on study holidays in 2019, and the figure is expected to increase in the future. The country’s wealthier families prefer high-quality hotels when they travel. According to Trip.com, in 2021, most of the parents who travelled with children were below 40 years old, and 50% of them favoured four and five-star hotel accommodation.

The Role of Airlines in China – Come Fly With Me?

During the pandemic, “Five one policy” and “Circuit breaker measures” were applied on international flights to and from China.

“Five one policy”: Basically, Chinese airlines were only allowed to maintain one route per destination country and one flight per week. Foreign airlines were allowed only one route to China and one flight per week.

“Circuit breaker measures”: If the number of COVID cases on any international flight reaches five, the flight will be suspended for two weeks; if it reaches 10, the suspension will last four weeks. After the end of the “circuit breaker” period, the airline could resume its one weekly flight schedule.

Therefore, we’ve seen a lot of changes in connectivity. For example, between the UK and mainland China, all direct flights were suspended from August 2021. On the other hand, Finland has a good connection with China. Finnair and Juneyao Air operate two flights per week between Helsinki and Shanghai. And they entered a joint business partnership, where the two carriers cooperate on Helsinki–Shanghai flights as well 57 points beyond China and 65 beyond points in Europe.

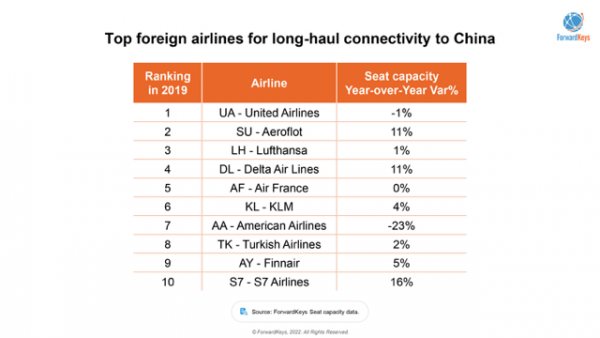

Looking again at ForwardKeys data, the top 10 foreign airlines for long-haul travel by seat capacity in 2019 show flight connectivity to Europe had been improved by major airlines, while the capacity to the USA had been decreased by United and American airlines. Will this remain the same post-Covid is the big question?

There is also a decreasing trend on airfares for China domestic travel. Even before the pandemic, airfares decreased by 17% between 1999 and 2019, which is mainly because of the competition with well-developed high-speed rail in China.

“During the pandemic, airlines have offered a lower price and even ‘unlimited flight passes’ to stimulate travel demand, so we should expect higher competition in a post-pandemic world,” points Dai.

What if?

The big what if China reopens questions holds a lot of promise and anticipation for many businesses and destinations dependant on the Chinese shopping dollar. The experts at ForwardKeys feel confident that the recovery will be swift, as the recovery of domestic tourism has demonstrated. The thirst to travel and spend exists, but the focus has shifted to more personalised experiences over group tours.

According to China’s 14th five-year plan (2021-2025), the basic goals of tourism development are the tourism industry’s upgrading, including high-quality tourism services, innovative tourism formats and different experiences.

“I think this is what we will see vastly change from the past norms, the new Chinese traveller is seeking something different in terms of experiences. The younger generation is a lot more independent than the previous generations keen to explore nature, sports and local gastronomy… more than before, so expect significant changes in Chinese traveller behaviour once travel resumes,” concludes Nan Dai, China Market Expert based in Xiamen in China.

(Source: ForwardKeys – Adriana Petkov)