SINGAPORE, 22 April 2022: Like it or not, China has kept making the headlines since the advent of the pandemic in 2020, and it’s for all sorts of reasons, says ForwardKeys’ latest trends update.

Despite Covid containment and the strict zero policy that closed outbound tourism, there remains an unstoppable desire to shop and travel – even if it’s just to neighbouring Macau or Hainan.

The latest news is the lockdown of one of China’s most important financial centres: Shanghai. And now, local authorities are telling Beijing residents to stay put ahead of the famous May holiday. But is it all doom and gloom for the travel economy?

“While short-term prospects are not optimistic, there are shifts in consumer sentiment that offer a brighter outlook for the long-term,” according to Dragon Trail International’s director of marketing and communications, Sienna Parulis-Cook.

Dragon Trail’s Spring 2022 Chinese Traveller Sentiment Survey shows an increase in Chinese consumers who say they’re “eager to travel” and improved safety perceptions for international destinations the world over.

According to ForwardKeys’ China Market Expert, Nan Dai, “Forward bookings for domestic travel in the upcoming Labour Day holiday may be distressing. They are 92% behind the same period last year. However, some valuable insights may ease concerns for some luxury brands and destinations.”

Tier-2 Airports Recover Quicker than Tier-1

With Shanghai in lockdown and Beijing residents told to stay put for the Labour Day holiday, the two biggest source markets for domestic travel may make travel professionals feel uneasy.

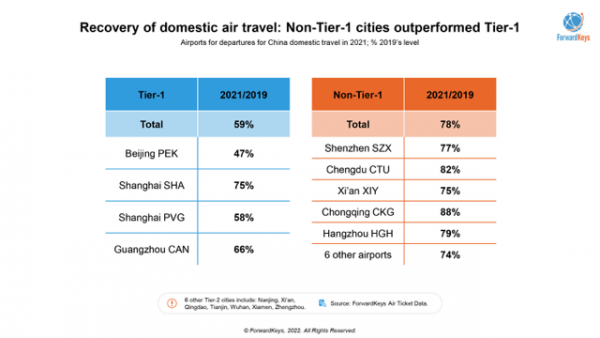

However, fortunately, the latest air ticketing data from ForwardKeys shows that the travel recovery from tier-2 cities has been outperforming tier-1 since 2021.

In 2021, Beijing, two airports in Shanghai, and Guangzhou recovered to 59% of the pre-pandemic level, with Beijing reaching only 47% of 2019’s level, Shanghai Hongqiao at 75%, and Guangzhou at 66%, and Shanghai Pudong at 58%.

But look at the figures for non-tier-1 cities: Chengdu, with 82% recovery, and Xi’an, with 75% recovery. Chongqing and Hangzhou took third and fourth place, each with a recovery of 88% and 79%.

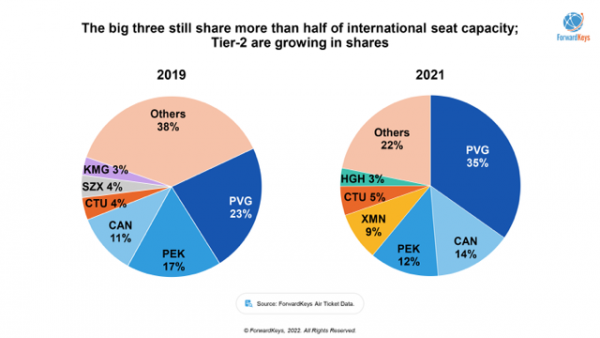

Another interesting trend occurred; non-hub airports increased 10% shares in seat capacity in 2021. And more revealingly, international traffic concentrated more on tier-2 cities like Xiamen, Chengdu, and Hangzhou.

Chengdu wins again with the latest government decision to shorten the quarantine period for international travellers. From 11 April until 8 May, China has started a trial to reduce quarantine from 14 days to 10 days for international arrivals to eight key cities. The selected gateways are Shanghai, Guangzhou, Chengdu, Dalian, Suzhou, Ningbo, Qingdao, and Xiamen.

According to Dragon Trail’s latest research, quarantine remains the biggest obstacle to outbound travel, with 46% of respondents saying they would consider outbound travel when there is no longer any need to quarantine on either end of the trip. Compared to a previous survey in September 2021, those wishing quarantine to be stricter have dropped from 36% to now 28%. Instead, those preferring that it stays the same have grown from 28% to 32%.

Chengdu, the rising origin market for affluent travellers to Hainan

When examining the booking patterns for travel to Hainan, we see travellers flying in premium classes were up by 2% in Q1 2022 compared to last year, while economy class bookings are down by 3%.

“If we break down the performance for its top source markets, Beijing and Shenzhen were the top markets for premium cabins. However, affluent travellers from Chengdu jumped to the third position, with significant growth of 74%,” says ForwardKeys’ analyst Nan Dai.

Shanghai’s performance was affected by the recent lockdown, but a general 4% growth in Q1 was thanks to an increase of 48% in January and February. Is this the waft of opportunity for the luxury market?

While more than a quarter of respondents in Dragon Trail’s survey said that shopping was a reason to visit Hainan, this was not the main motivation for most travellers. 57% said their reason for visiting would be relaxing on the beach, with 51% choosing water sports, 42% choosing romance, and 27% seeing the island as a family holiday destination.

“This Labour Day holiday period may not show great signs of promise as forward bookings are down, but we’ve learned from this pandemic that the local tourism market in China is resilient and that last-minute bookings have become the norm. Most bookings these days are made less than four days before departure,” says ForwardKeys’ analyst Nan Dai.

“Even more promising in China is the growing importance of Tier-2 airports on domestic and international travel. In 2021, we even saw several designer fashion brands open flagship stores at once-deemed rural airports.”

Improved perceptions of outbound destinations

Dragon Trail asked survey respondents to rank the safety of 15 outbound destinations. Except for Hong Kong, travellers’ perceptions of outbound destinations as being “unsafe” have decreased across the board, with increasing numbers categorizing the destinations either as “safe” or “unsure”.

Japan saw the most significant increase in safety perception. Even the US – which has ranked as most “unsafe” in all of Dragon Trail’s sentiment surveys – has seen an improvement, with 7% categorizing it as “safe,” compared to 69% as “unsafe.” Just six months earlier, 87% saw the US as “unsafe”. As in previous surveys, Singapore was ranked as the safest destination beyond Greater China.

“It’s heartening to see that while other countries around the world are dropping Covid restrictions and opening to international travel, this is not negatively affecting their perception by Chinese travellers. Safety ratings have improved for every country in our survey over the last six months,” added Dragon Trail International’s director of marketing and communications, Parulis-Cook.

A Dragon Trail International and ForwardKeys webinar on 28 April will release more data on China travel trends. To register, check the link: https://us06web.zoom.us/webinar/register/WN__M0KYjg2S_SJGJ8dDBKxLQ