VALENCIA, 26 March 2021: With the 28th edition of SATTE (South Asia’s Travel & Tourism Exchange) taking place this week in India, experts at ForwardKeys, examined the latest air ticket data to see how this South Asian giant’s domestic and international travel plans are panning out.

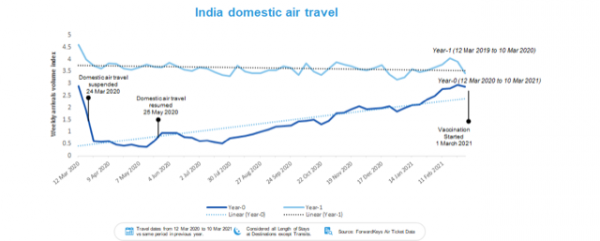

Domestic air travel in India back to 84% of 2019 levels

The upward trajectory was disrupted from mid-June to mid-July but quickly regained steam after that. In the first week of March 2021, domestic passengers had bounced back to 84% of 2019 levels. Back in the lowest month of April 2020, domestic passengers were at 14% of 2019 levels.

Following the Indian Government’s announcement that domestic flight operations could resume from 25 May 2020 through a calibrated approach, ForwardKeys’ air ticketing data reveals that domestic air travel has started, although the path to recovery has been bumpy.

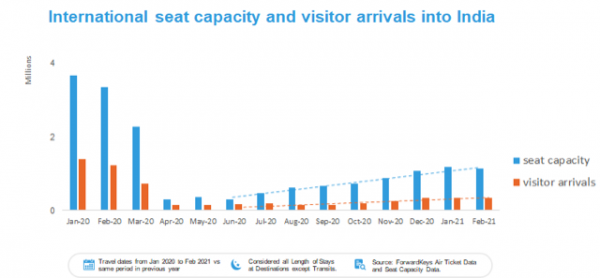

Air travel bubbles spur restoration of international seat capacity

International commercial passenger flights had been suspended for over a year now – since 23 March 2020 when the national lockdown restrictions were imposed.

From Q3 last year, India began setting up air bubble agreements with various countries. Since 22 October 2020, it started permitting foreigners to enter India on all visas, except for tourist visas. As of March, India has formed travel bubble arrangements with 27 countries.

Spurred by India’s incremental expansion of air bubbles over the past eight months, international air travel seat capacity into India has clawed back steadily, from 10% of the pre-pandemic level in June 2020 (June 2020 vs June 2019) to 34% in February 2021 (February 2021 vs February 2020).

However, with leisure visas still under suspension and Covid-19 uncertainties looming like many other parts of the world, visitor arrivals into India remain expectedly low, with visitor arrivals recording 14% of the pre-pandemic level in June 2020 (June 2020 vs June 2019) and 28% in February 2021 (February 2021 vs February 2020).

Since June 2020, taking the lead from India’s air bubble developments and eyeing the leisure travel comeback in one of the biggest inbound tourism countries, airlines have been cautiously restoring international seat capacity into India and repositioning themselves to secure a head-start.

The upward trajectory in seat capacity has been sharper than the clawback in visitor arrivals. In the first two months of 2021, international seat capacity into India recorded 33% of 2019 levels, while visitor arrivals lagged at just 26% of 2019 levels.

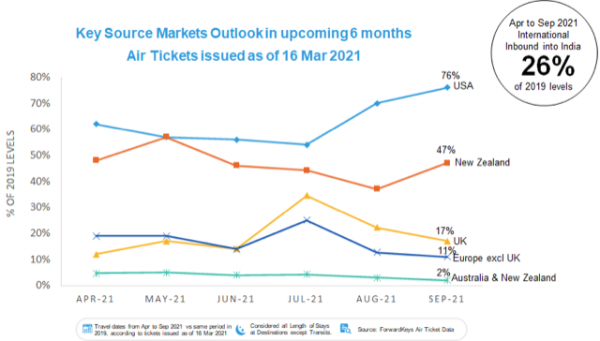

Early signs of pandemic shifts in source markets.

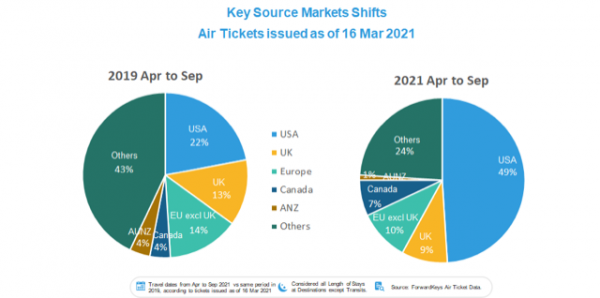

The source markets mix has shifted for destination India due to the pandemic.

“Leading the preliminary recovery is the USA (76% of 2019 levels), followed by Canada (47%), UK (17%), Europe excluding the UK (11%), Australia and New Zealand (2%),” says ForwardKeys APAC director Jameson Wong,

Comparing April to September 2021 against the same six months in 2019, a significant shift in source markets is evident.

“The USA, which used to account for 31% of actual air tickets into India pre-Covid from April to September 2019, has doubled, up by 60% for the next six months. Canada, which used to account for 6%, now has grown to 10%. Is India ready to welcome North American travellers?” asks Wong.

The UK, a traditional source market which used to constitute a sizeable 13%, has shrunk by more than half to only 6%. Europe, excluding the UK, has slid from 16% to 12%. Australia and New Zealand, combined, has dropped drastically from 6% to 1%.

Though not yet reflective of the true estimate of the leisure travel rebound as India still has leisure visas under suspension, such early signs of pandemic shifts in the traveller source markets to Destination India indicates the need for a change in planning and, exciting, new business opportunities, top-down. From government level to operator level.

ForwardKeys’ air ticketing data enables tourism stakeholders to deep dive into actional insights, making sound business decisions backed by real-time data and science. “We dissect the full traveller’s journey, from start to finish,” says South Asia market expert Ram Badrinathan.

“Our data can help your business discover who is travelling when, where and for how long. Have the lead booking times changed? What about the passenger profile? Is flight connectivity the issue? So many details useful to recover your Covid-19 related losses,” adds Badrinathan.

Visit ForwardKey’s website to learn more: www.forwardkeys.com