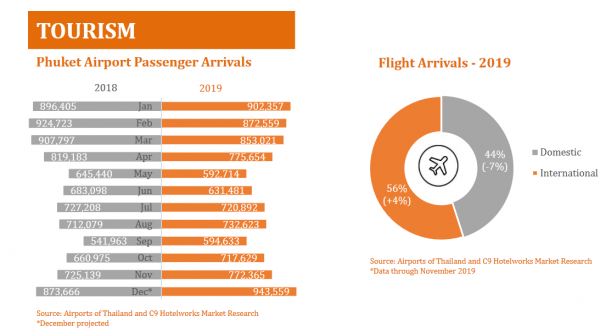

PHUKET, 7 January 2020: Robust passenger arrivals in the second half of 2019 highlighted by growth in Indian tourists helped rebalance the island’s tourism sector according to the C9 Hotelworks newly released Phuket Hotel Market Update.

The addition of direct flights from Mumbai, Dehli and Bengaluru propelled numbers by 298% versus the same period in the previous year.

In 2019, year-on-year passenger arrivals declined in Q1 (-4%) and Q2 (-7%) due to international economic volatility, China-US trade tensions, and a strong Thai baht. Long-haul travellers from Australia and European countries (led by Scandinavia, Germany, and Italy) shrank. Moreover, Chinese arrivals moved into troubled territory with a 9% decline.

However, passenger arrivals notably regained momentum in Q3 (3%) and Q4 (8%). The demand came from regional Asian feeders (led by India, Malaysia, and Singapore).

Overall for the year passenger arrivals in 2019 are forecasted to be similar to 2018, but punctuated by a second-half rising trend. In 2019, passenger arrivals at the Phuket International Airport should total 9,109,487, with the December year-on-year monthly 2019 figure forecasted to be up by 8%.

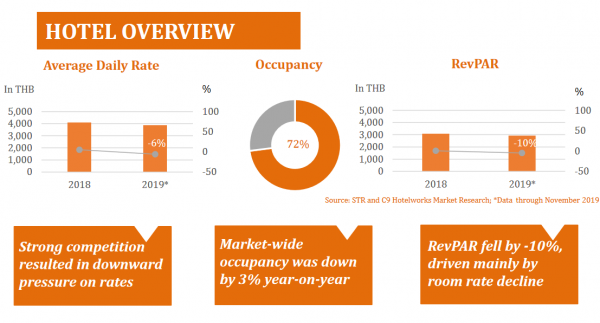

Citing recent media reports about Phuket’s hotels being half empty, C9’s Managing Director Bill Barnett stated: “Current 2019 data that reflects over 9 million passenger arrivals at Phuket International Airport, and hotel occupancy levels for the year in the low 70’s is contrary to the media claims which are largely unsupported by a lack of metrics.

“While 2019 saw a slight drop in occupancy and marked reduction in average rates and RevPAR, these are mainly attributed to an appreciating Thai baht and reaction to increased competition in leisure destinations. The latter part of 2019 trending showed higher demand which is encouraging, but seasonable challenges remain a key challenge.”

Looking at key hotel performance trends, the second half growth spurt in demand drove full-year market-wide occupancy to 72% according to data from STR, which is 3% lower versus 2018.

Rate pressure remains intense and a challenge to RevPAR; with Thai currency appreciation set to continue in 2020. Two key metrics that were impacted was a drop in island average rates by 6%, and the knock-on impact to RevPAR that also stepped back by 10%, largely driven by lower room rates.

Download full report:

https://www.c9hotelworks.com/news/c9-hotelworks-new-phuket-hotel-report-released.php